Reykjavik’s retailers are urged to prepare for big swings in US visitors

ForwardKeys, which predicts future travel patterns by analysing 17 million booking transactions a day, used two of its unique datasets to reveal the latest findings, Seat Capacity and Total Air Market. They are crucial tools for all businesses that need to know and understand travel patterns. For example, retailers who rely on sales to international travellers can make smart decisions about promotion, staffing and stock selection if they know in advance when affluent travellers from specific countries will be passing their stores.

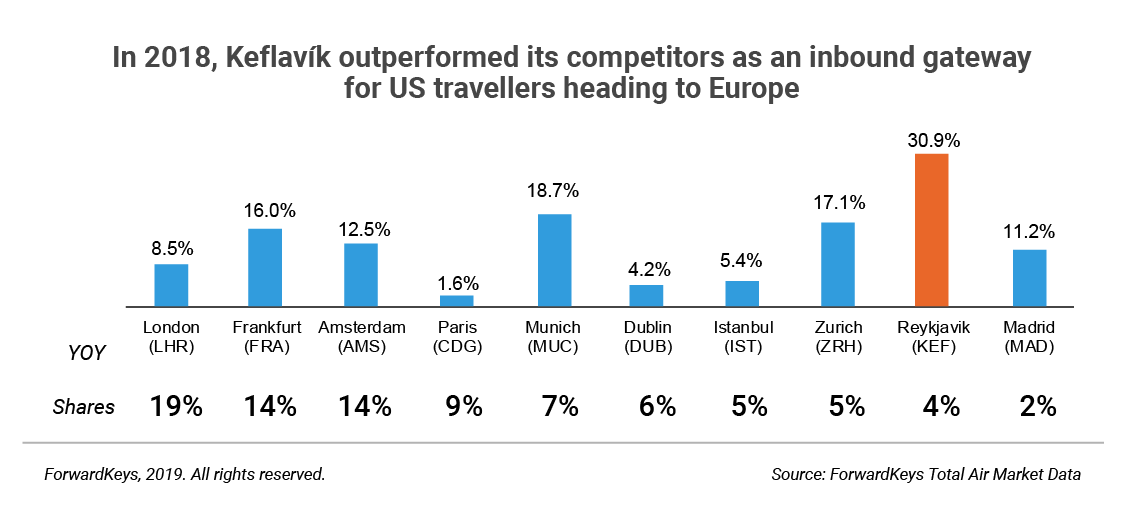

Iceland has a 4% share among other gateways for European transfer arrivals from the US. By comparison, London, with the top 19% share, grew by 8.5% in 2018. The second biggest growth – behind Iceland – was Munich, up 18.7%, with a 7% share.

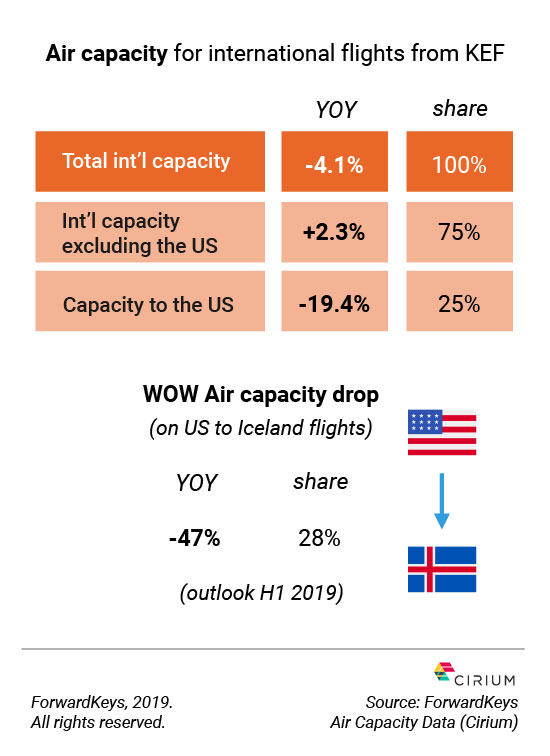

However, ForwardKeys predicts that the impressive growth in Keflavik’s American passenger numbers will stall in the first half of this year, largely due to WOW Air, the Icelandic low-cost carrier, reducing its US routes. Total scheduled seats for international flights from Iceland, January to June this year, are down 4.1%. Capacity to the US (which makes up 25% of Keflavik’s international traffic) has dropped by 19.4%, as WOW Air, with 28% of that, is providing 47% fewer seats to the US. By comparison, traffic to other destinations looks set to increase slightly, as overall capacity to all other international destinations will increase by 2.3%.

Olivier Ponti, VP Insights at ForwardKeys, said: “There’s no question that the changing profile of travellers going through Reykjavik’s international airport will have implications for the sellers of branded goods and duty-free merchandise there. For example, clothing retailers will probably need to rethink stock levels and in particular the number of garments in each size.”

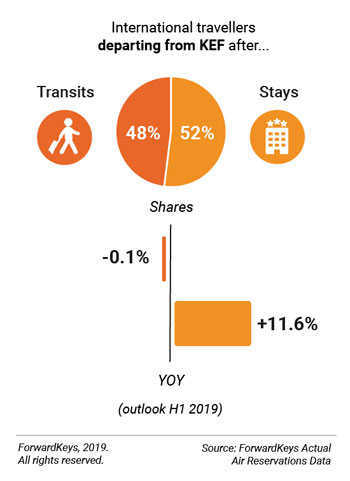

Forward bookings for transits (a 48% market share) are lagging 0.1% on last year’s strong performance. However, bookings for onward journeys after a stay of at least one night (52% market share) are ahead 11.6% year-on-year…

… which Olivier Ponti pointed out: “should be encouraging news for Reykjavik’s hoteliers.”

Ends

Ends